foreign gift tax uk

You will not have to pay tax on this. Donations tax is payable by the donor and not the recipient - therefore there are no tax implications for you however you need to disclose it in your tax.

Non Us Investor S Guide To Navigating Us Tax Traps Bogleheads

Tax rates and exemptions are the same for nationals and.

. Here at Ingleton we understand the complicated nature of the taxation of gifts. Person who received foreign gifts of money or other property you may need to report these gifts on form 3520 annual return to report transactions with. Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax.

We can help support your taxissues with advice and planning strategies whether you are a US or. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520. The standard rate for inheritance tax in the UK is 40.

13 April 2016 at 938. 1 IRM 425441 paragraph 2 was revised to provide current instructions for requesting FATCA data in estate and gift tax examinations. Person gives a gift that exceeds the annual exclusion amount they typically must file a Form 709 unless an exception or exclusion.

In addition to the unified exemption both US. Rates and reductions on inheritance tax in the UK. 11 hours agoForeign Secretary James Cleverly refused to commit to a plan to freeze UK corporation tax next year -- a key part of Liz Trusss attempt to boost growth -- as ministers.

Foreign Gift Tax Uk. Foreign Gift Tax the IRS. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the.

There will be no income tax due on the gifting of money. Sending more than one gift. Person who received foreign gifts of money or other property you may need to report these gifts on form 3520 annual return to report transactions with.

Tax implications for migrants. However if you are UK tax resident and you make a capital gain abroad from the sale of a property. A non-domiciled person someone who lives in the UK but may have permanent residency in another country can receive tax-free allowances in.

Your executor might be able to reclaim tax through a double-taxation treaty if Inheritance Tax is charged on the same assets by the UK and the country where you lived. If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value. Find out whether you need to pay UK tax on foreign income - residence and non-dom status tax returns claiming relief if youre taxed twice including certificates of residence.

The gift tax rates range from 18 to 40 and reach the highest rate at 1 million of value. If youre sending more than one gift in the same parcel you get the Customs Duty and VAT-free allowance for each gift if theyre. However if you are UK tax resident and you make a capital gain abroad from the sale of a.

This value is adjusted. The standard rate for inheritance tax in the UK is 40. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and.

If you are a US. Domiciliaries have an annual. 16 rows Estate Gift Tax Treaties International US.

Then this will need to. 13 April 2016 at 938. Foreign Gift Tax Uk.

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Uk Inheritance Tax Law And Wills For Foreigners Expatica

Taxation In The United Kingdom Wikipedia

Making A Cross Border Donation From The United Kingdom Transnational Giving Europe

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

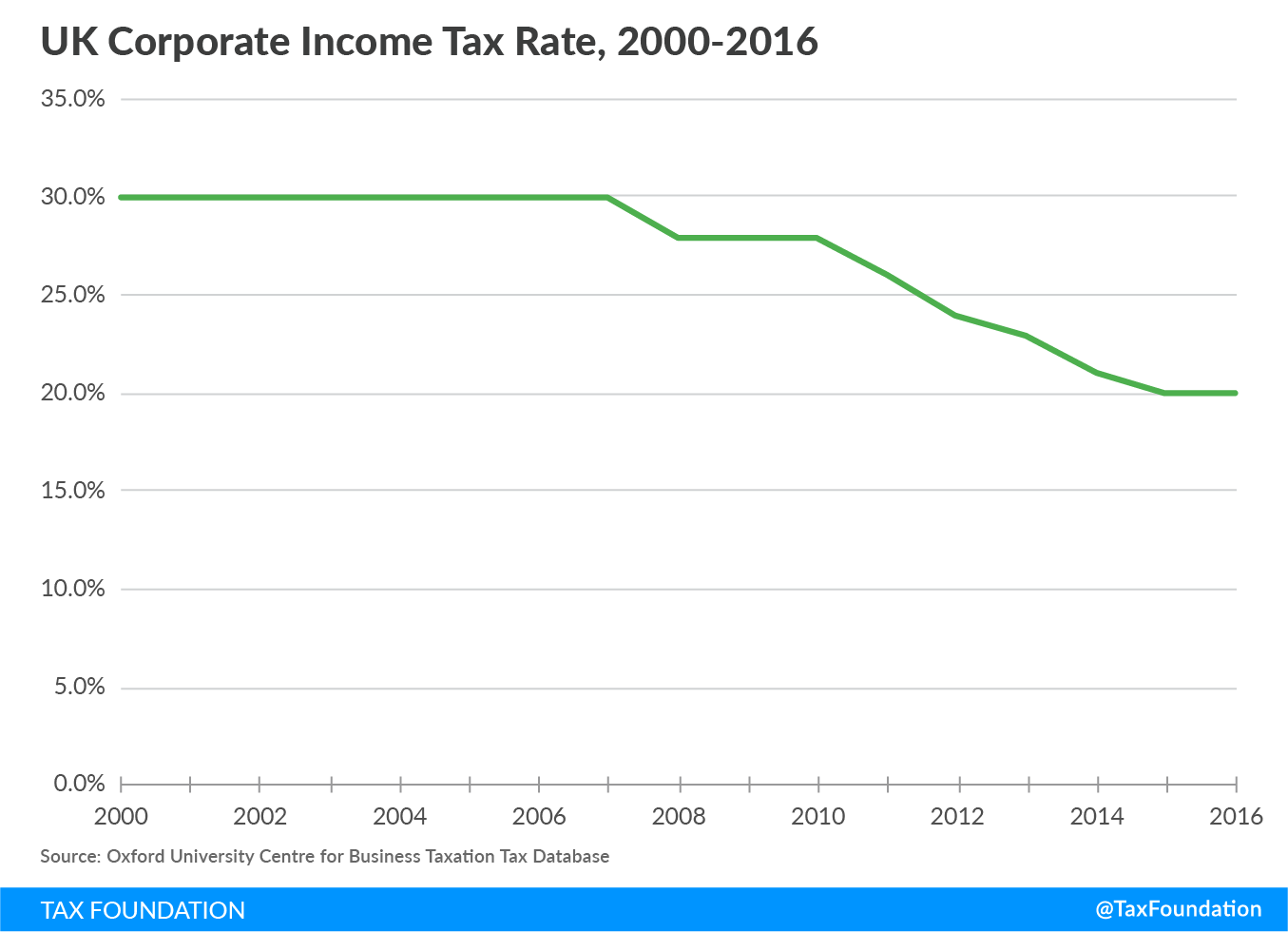

What We Can Learn From The Uk S Corporate Tax Cuts Tax Foundation

Gift And Estate Tax Archives The Wolf Group

A Guide To Tax On Foreign Income 1st Formations

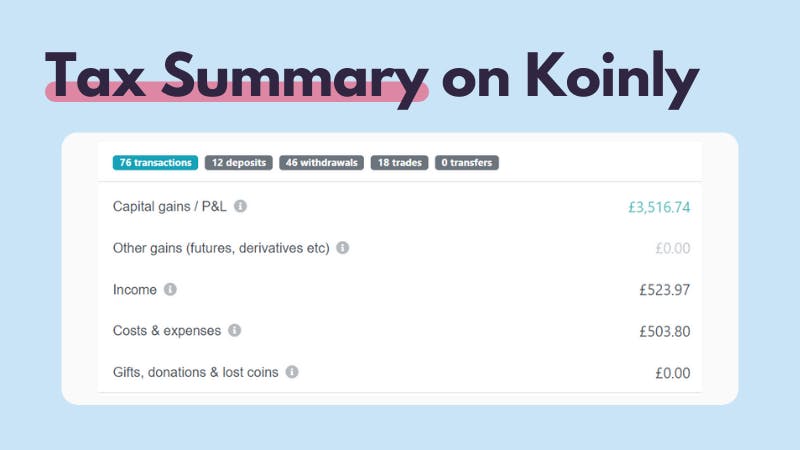

Crypto Tax Uk Ultimate Guide 2022 Koinly

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

When Are Gifts Received By Nris Subject To Tax Tds In India The Economic Times

A Deep Dive Into U S Estate And Gift Tax Treaties Sf Tax Counsel

Uk Inheritance Tax Law And Wills For Foreigners Expatica

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Non Citizens And Us Tax Residency Expat Tax Professionals

How Are Gains On Foreign Stock Investments Taxed Forbes Advisor India

What Are The Consequences Of The New Us International Tax System Tax Policy Center